north carolina estate tax 2021

A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. North Carolina has no inheritance tax or gift tax.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate.

. North Carolina Department of Revenue. Owner or Beneficiarys Share of NC. Starting in 2022 the exclusion amount will increase annually based on.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Application for Extension for Filing Estate or Trust Tax Return. Ad The Leading Online Publisher of National and State-specific Legal Documents.

PO Box 25000 Raleigh NC 27640-0640. So if you live in N. Carolina but inherit assets from an estate in another estate you could have to pay inheritance tax.

The tax rate on funds in excess of the exemption amount is 40. North carolina estate tax 2019. Article 1A - Estate Taxes.

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. NC K-1 Supplemental Schedule. For the year 2016 the lifetime exemption amount is 545 million.

For Tax Year 2019 For Tax. 117 million increasing to 1206 million for deaths that occur in 2022. Federal exemption for deaths on or after January 1 2023.

Skip to main content Menu. Popular Counties All A B C D E F G H I J K L M N O P R S T U V W Y Z. 7031 Koll Center Pkwy Pleasanton CA 94566.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. The state of North Carolina offers a standard deduction for taxpayers.

105-322 - Repealed by Session Laws 2013-316 s7 a effective January 1 2013 and applicable to the estates of decedents dying on or. The North Carolina income tax rate for tax year 2021 is 525. Select the North Carolina city from the list of popular cities below to see its current sales tax rate.

After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent. For tax year 2021 all taxpayers pay a flat rate of 525. Counties in North Carolina collect an average of 078 of a propertys.

North Carolina state income tax Form D-400 must be postmarked by April 18 2022 in order to avoid penalties and late fees. 078 of home value. We will update this page with a new version of the form for 2023 as soon as it is made available by the north carolina government.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Individual income tax refund inquiries. 105-321 - Repealed by Session Laws 2013-316 s7 a effective January 1 2013 and applicable to the estates of decedents dying on or after that date.

The District of Columbia moved in the. The marital deduction allows property and assets left to the spouse to be exempt from the federal estate tax. Beneficiarys Share of North Carolina Income Adjustments and Credits.

Estate and inheritance taxes are burdensome. The state sales tax rate in North Carolina is 4750. Fortunately few states impose an inheritance tax.

The North Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Carolina State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. A federal estate tax is in effect as of 2021 but the exemption is significant. The exemption is 4 million as of 2021.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The 2021 standard deduction allows taxpayers to reduce their taxable income by 10750 for single filers 21500 for married. You can contribute up to 80000 75000 for tax year 2021 toward a 529 plan without reducing your lifetime gift and estate tax exemption as long as you dont contribute any more toward a 529 plan with the same beneficiary for the next five years.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. See below for a chart of historical Federal estate tax exemption amounts and tax rates. In fact the IRS does not have an inheritance tax while some states do have one.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. Basically the IRS lets you use five years worth of your annual exclusion in one shot. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion.

With local taxes the total sales tax rate is between 6750 and 7500. Home File Pay Taxes Forms Taxes Forms. Federal Estate Tax Death Tax Only estates exceeding 114 million.

When ownership in north carolina real estate is transferred. Printable North Carolina state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. North Carolina has recent rate changes Fri Jan 01 2021. The tax basis is the gross value of an entire estate including half of the value of property owned with someone else.

The North Carolina Department of Revenue is responsible. 2021 North Carolina General Statutes. Link is external 2021.

Tax amount varies by county. Chapter 105 - Taxation. The current federal estate tax exemption for 2021 is 117 million per individual.

During the Houses June 16 meeting Szoka estimated that eliminating the pension taxation for military retirees would have a revenue decrease of. Get Access to the Largest Online Library of Legal Forms for Any State.

Irs Tax Problems Irs Taxes Tax Debt Debt Relief

Probate Fees In North Carolina Updated 2021 Trust Will

Planting Fields Foundation Public Garden Planting Fields Arboretum Plants

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Lexisnexis Practice Guide North Carolina Estate Planning Lexisnexis Store

Understanding North Carolina Inheritance Law

Pin By Susan Herrmann On Retirement In 2022 Order Of Operations Estate Planning Federal Income Tax

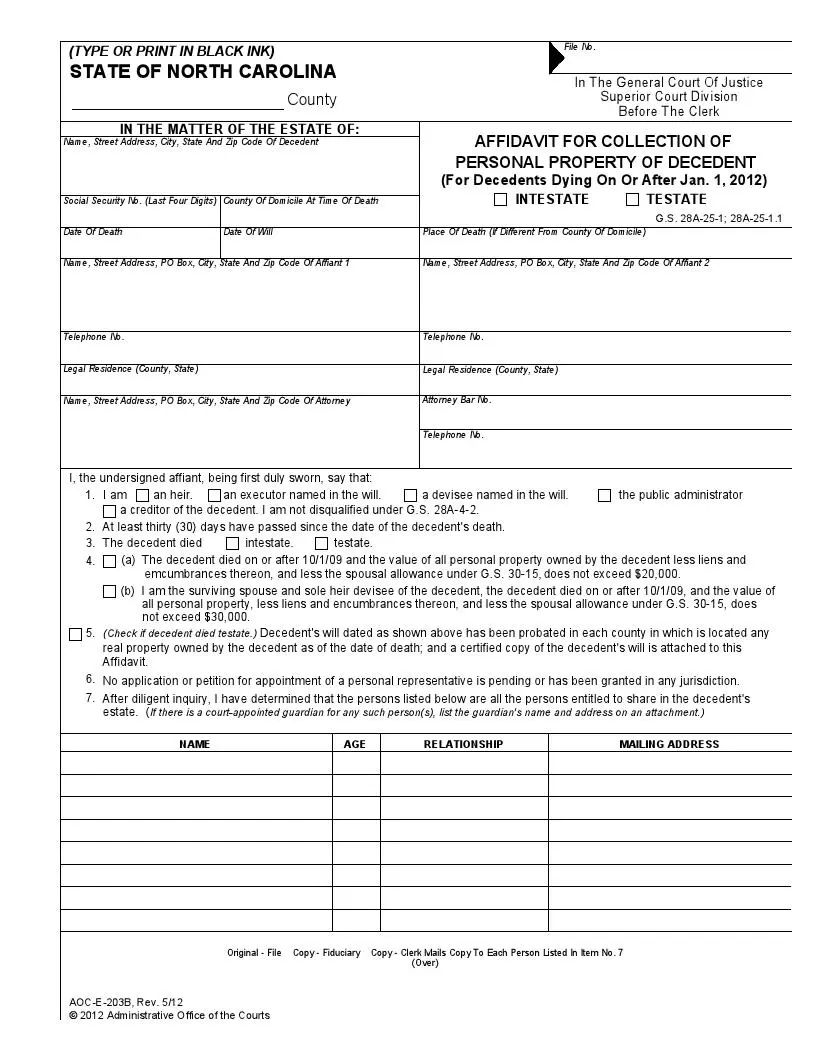

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Last Will And Testament Legalzoom Com

North Carolina Estate Settlement Practi Legal Solutions

North Carolina State Taxes 2022 Tax Season Forbes Advisor

North Carolina Estate Tax Everything You Need To Know Smartasset

Pin By Reg Davies On Taxes Charlotte Nc Filing Taxes Identity Theft Tax Return

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Here Are The Most Expensive Homes For Sale In North Carolina Cbs 17