student loan debt relief tax credit virginia

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Allows employers to reimburse employees 5250 anually for tuition student loan relief.

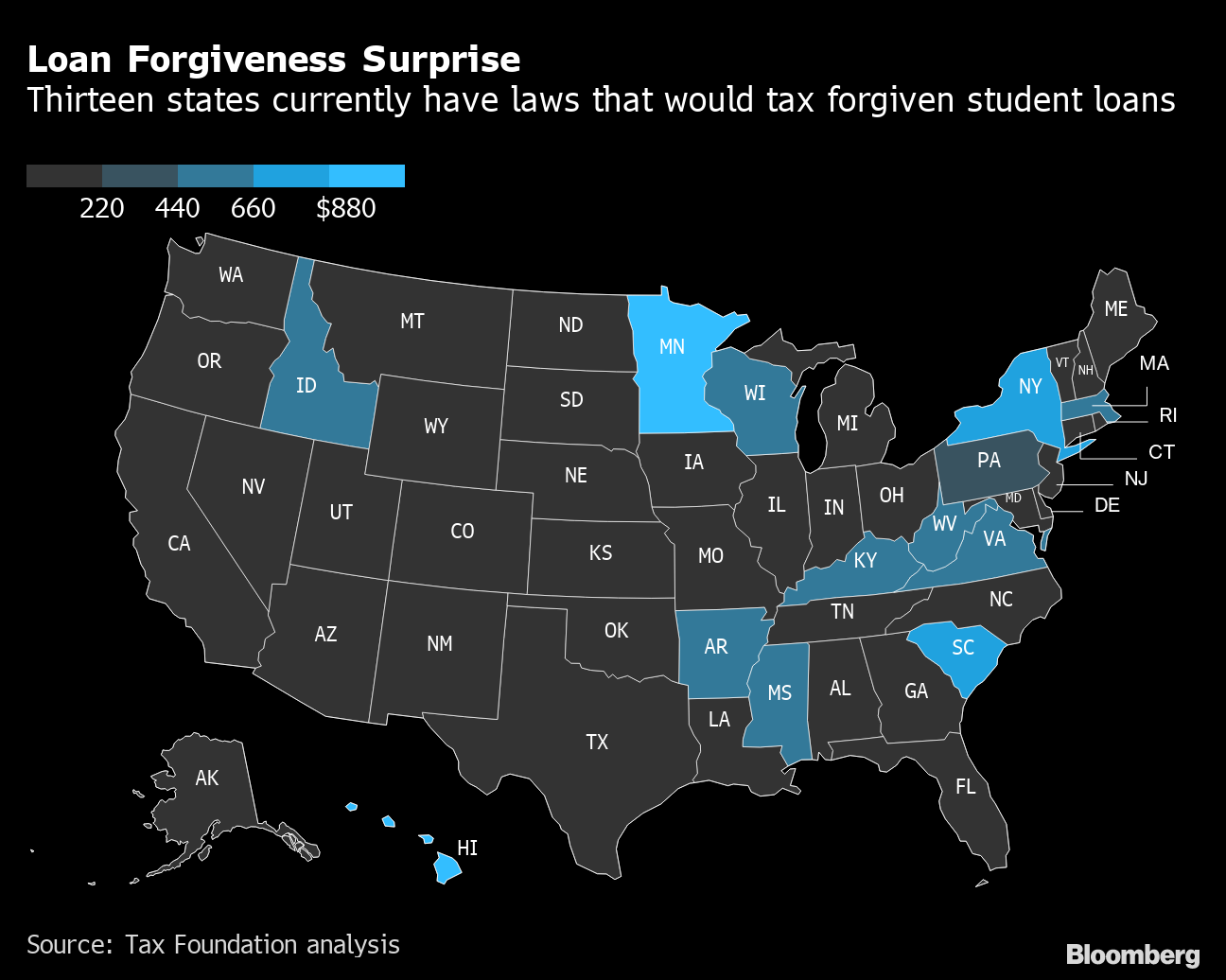

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Complete the Student Loan Debt.

. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief tax. How much money is the Maryland Student Loan Debt Relief Tax Credit.

Get details about one-time student loan debt relief. The president is erasing 10000. We Help Taxpayers Get Relief From IRS Back Taxes.

NEW YORK AP. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. An official website of the State of Maryland.

The Biden Administrations Student Loan Debt Relief Plan Part 1. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Ad All it takes to get started is a 99 one-time fee for a Core 127 EAP document package.

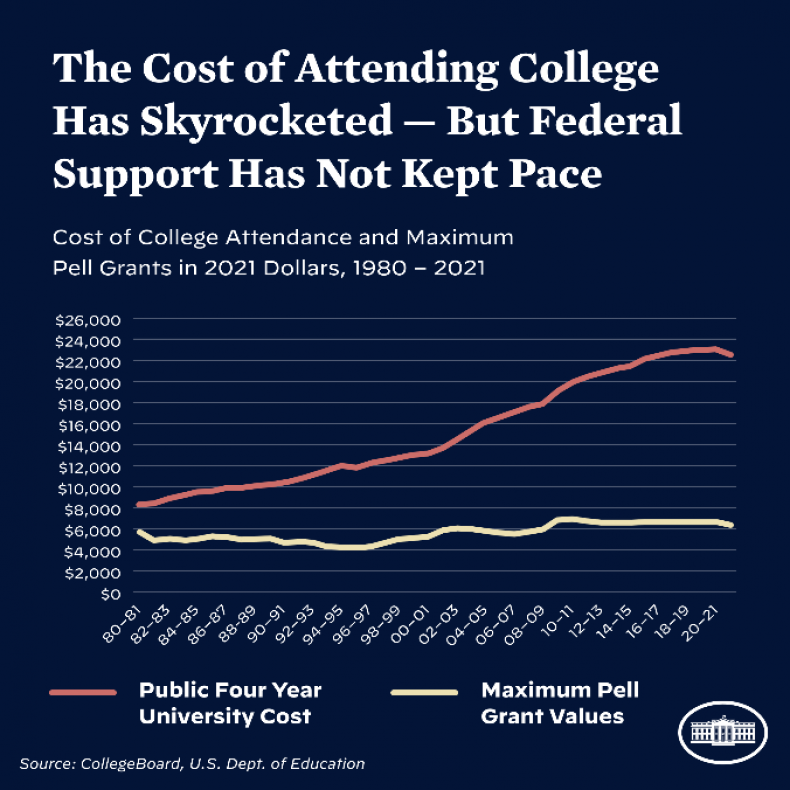

September 14 2022 757 pm. Going to college may seem out of reach for many Marylanders given the. More than 40 million Americans could see their student loan debt cut or eliminated under the forgiveness plan Biden announced late last month.

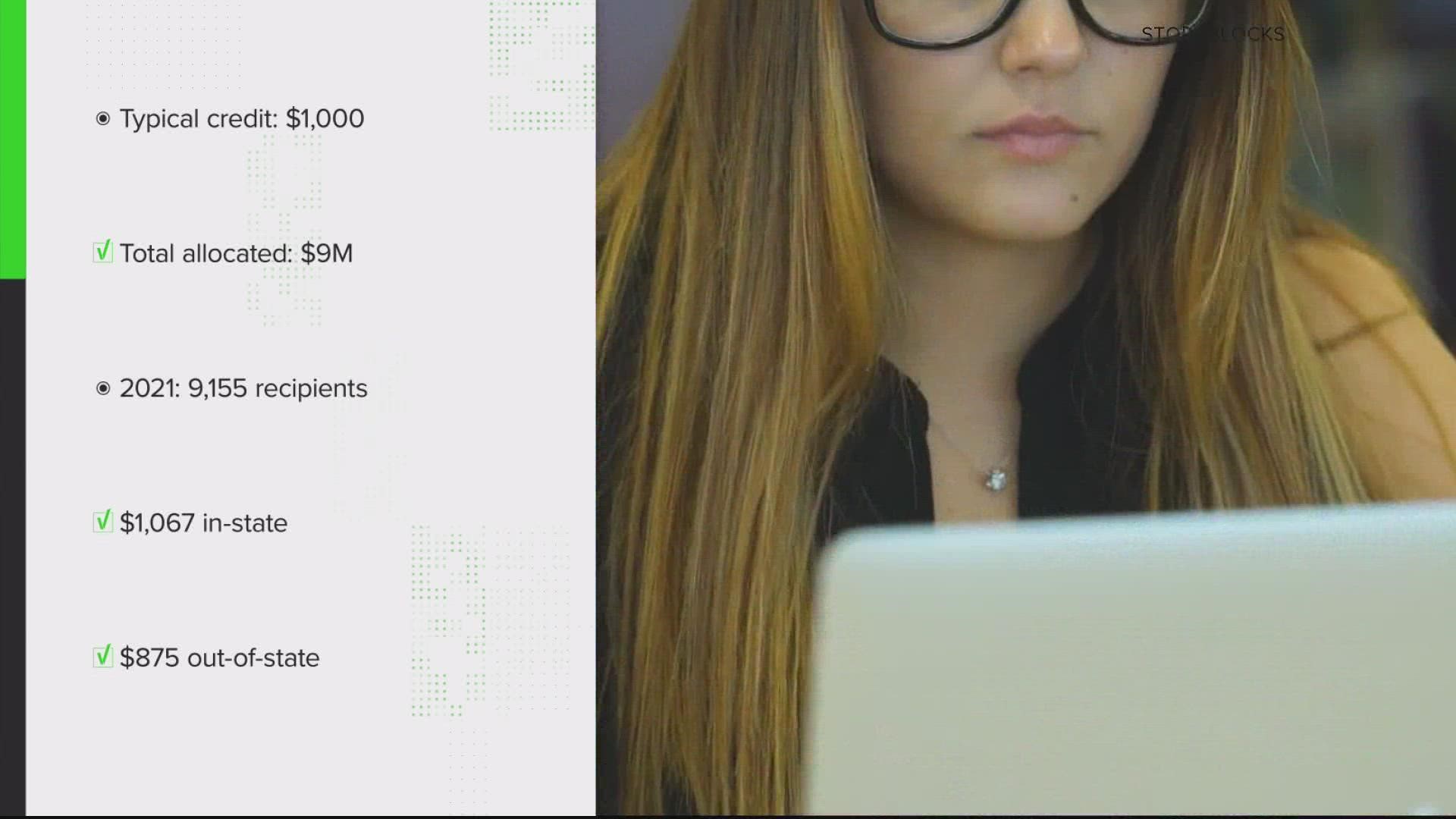

This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. The state is offering up to 1000 in. In Indiana for example the state tax rate is 323.

Final extension of the student loan repayment pause. For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in. Virginia Debt Statistics.

19 hours agoUnder the new Biden program up to 10000 in federal student debt will be forgiven if you did not have a Pell Grant while in college. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. 1 day agoThe Department of Education says borrowers who hold eligible federal student loans and have made voluntary payments since March 13 2020 can get a refund.

The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Due to the economic.

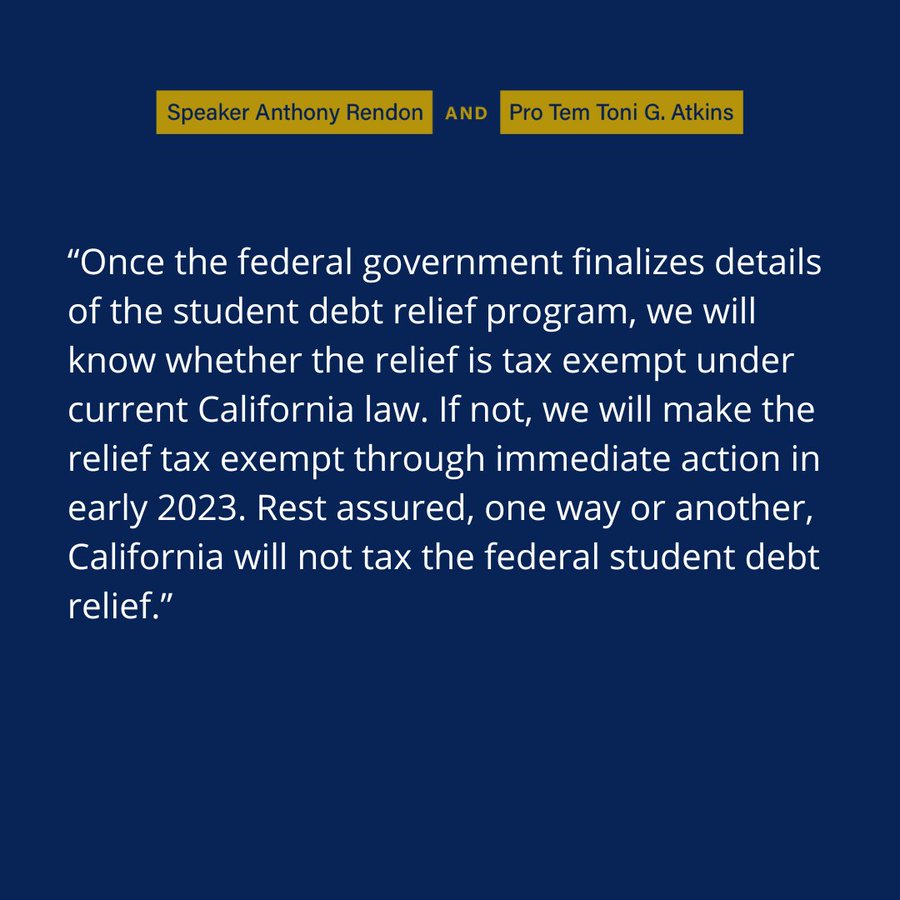

Over 8 million federal student loan borrowers live in one of the states that will tax debt relief according to federal data from March 2022. Virginia is the 18 th richest state and richest. The Tax Foundation predicts that the.

For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who. But up to 20000 in federal student. For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in.

Residents of 13 states who receive debt forgiveness from the federal government for their student loans may need to pay some state taxes on their forgiven amount according. If youre one of the thousands of Marylanders dealing with mounds of student loan debt you still have time to apply for Marylands Student Loan Debt Relief Tax Credit. Its been just over a week since President Joe Biden made the announcement that up to 10000 worth of federal student loans per borrower and up to 20000 for Pell Grant.

BALTIMORE -- If youre one of the thousands of Marylanders dealing with student loan debt you still have time to apply for Marylands Student Loan Debt Relief Tax Credit. 8 hours agoIf you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. Free Case Review Begin Online.

The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept. Ad See If You Qualify For IRS Fresh Start Program. As of November 2020 Virginias unemployment rate sat at 49 slightly lower than the national rate of 67.

To qualify you must be making. Virginia Loan Forgiveness Program.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

/cloudfront-us-east-1.images.arcpublishing.com/gray/AYNZGNYFZRBJ7G7LWGIAHRAI6I.JPG)

Virginia Won T Tax Forgiven Student Loans Despite News Reports

Will You Owe Taxes On Forgiven Student Loans Borrowers In These States Will Cnet

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Biden Announces 10 000 In Student Loan Debt Relief The New York Times

Which States Are Taxing Student Loan Forgiveness As Usa

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan

Virginia Student Loan And Financial Aid Programs

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Will You Owe Taxes On Forgiven Student Loans Borrowers In These States Will Cnet

Who Has Student Loan Debt In America The Washington Post

West Virginia University Professor Talks Student Loan Debt Forgiveness Wv News Wvnews Com

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Student Loan Forgiveness Faqs The Details Explained Forbes Advisor

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Biden S Student Loan Forgiveness Could Be Serious Ethics Violation Gop